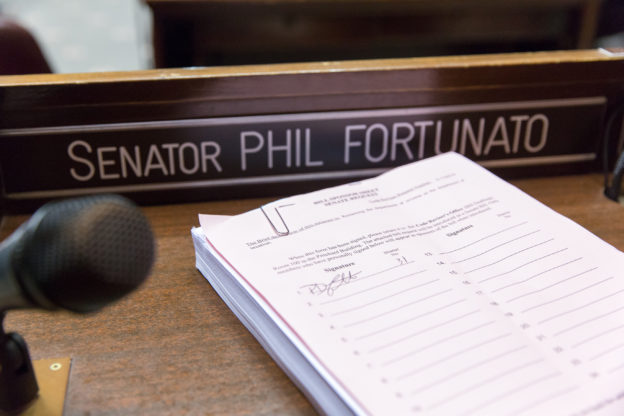

State Sen. Phil Fortunato, R-Auburn, voted against the final passage of the 2025-27 operating budget Sunday, warning that the real threat to Washington’s economy isn’t just the spending plan itself, but the damaging policies that have led to the state’s growing budget shortfall.

While others debated the budget’s specifics, Fortunato focused on the Legislature’s pattern of passing policies that he says are “killing the golden goose,” stifling economic growth, driving up costs for consumers, and ultimately shrinking the state’s revenue base.

“We are a sales tax-driven state,” Fortunato said during a floor speech. “If you want more tax revenue, you sell more stuff. But every time we raise taxes or impose new regulations, we take money out of consumers’ pockets and make it harder for businesses to succeed.”

Fortunato pointed to examples like the state’s environmental mandates on electric trucks, which led to a dramatic drop in truck sales and a $60 million loss in sales tax revenue from just one dealership. He also warned that recently approved rent control policies will discourage new apartment construction, further suppressing economic activity and future tax collections.

“We’re passing policies in a panic to plug budget holes, but in the process, we’re strangling the very economy we depend on to fund critical services,” said Fortunato. “Instead of fostering a thriving private sector, we’re making it harder for people to invest, build, and grow.”

The senator emphasized that without a stronger economy, efforts to support housing, healthcare, and other vital services will continue to falter.

“A thriving economy is what makes all these programs possible,” Fortunato concluded. “By killing the golden goose, we are setting ourselves up for deeper shortfalls and harder times ahead. That’s why I voted no.”

The latest policy is a proposal,

The latest policy is a proposal,  Awards ceremony honors ‘epic fails’ of 2021 legislative session

Awards ceremony honors ‘epic fails’ of 2021 legislative session