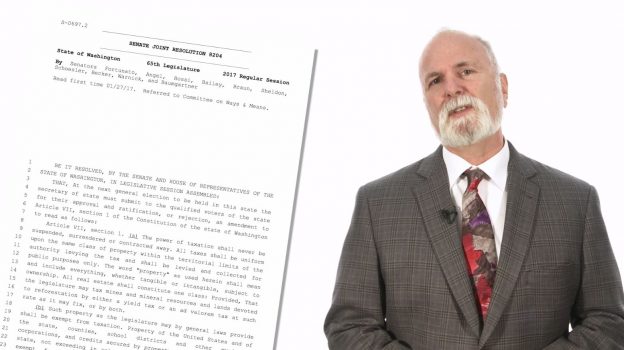

Sen. Phil Fortunato, R-Auburn, has introduced Senate Bill 5946, which would phase out state funding for The Evergreen State College and ultimately sell the institution. Fortunato says the controversy over the request for a white professor to leave campus that has embroiled Evergreen in a national media frenzy, reveals a dysfunctional state institution incapable of keeping order or protecting free speech.

“What I see is an institution dedicated to indoctrinating kids into being perpetual victims,” explained Fortunato. “We saw videos of students disrupting classrooms, bullying administration, blocking police, and intimidating those around them and the response from the college president was to thank them for it. It is unbelievable.

“When this bill passes, they can still feed each other all the Marxist nonsense they want, they just won’t be able to do it with money from my constituents unless my constituents choose to donate to it—which I doubt.”

The legislation would transition Evergreen into a private institution and would seek to sell college assets at fair market value. A stipulation to the sale would be that the buyer would have to run the college as a four-year institution of higher education. If no buyer is found or if that stipulation is not met, the college would be placed under the governance of the board of trustees at Washington State University (Eastern Washington University in the House version).

“The student protesters claim Evergreen is a horrible, oppressive place,” said Fortunato. “To those of us watching the behavior of these students and their intolerance of differing ideas, Evergreen looks like a horrible, oppressive place. So we come to the same conclusion for different reasons—Evergreen is a horrible place, so let’s stop putting public money in it.”

Fortunato’s bill is a companion to HB 2221, sponsored by Rep. Matt Manweller, R-Ellensburg.