The Washington Senate is poised to approve a bill Thursday that would allow the annual growth in property taxes to triple, flouting the will of Washington voters who approved a cap on property taxes in 2001.

Republican senators say they plan to raise stiff opposition when the bill comes to the floor – but may lack the votes to head off Senate Bill 5770. The measure would raise the current 1 percent cap on annual growth in property taxes without voter approval to 3 percent. Taxes could increase by as much as $6 billion over the next 12 years, and would keep compounding from there.

The measure is sponsored by Sen. Jamie Pedersen, D-Seattle, and co-sponsored by 18 members of the Senate Democratic Caucus. The measure was approved Feb. 5 by the Senate Ways and Means Committee on a Democrat-only vote. It currently is expected to reach the Senate floor for a vote sometime Thursday.

The Republican senators who comprise the Senate Freedom Caucus say the measure calls for the proverbial line in the sand. The four lawmakers, concerned primarily with issues of constitutional freedoms and political process, point out that Washington voters approved the 1 percent cap with Initiative 747 in 2001. When the state Supreme Court threw out the initiative in 2007 for technical reasons, the Legislature promptly convened a special session to reenact the limit.

The four lawmakers say the bill is based on false premises. “Increases in local property taxes are far outstripping the growth in personal income,” said Sen. Phil Fortunato, R-Auburn. “Cities have been reaping a huge bonus from the growth of construction. Of course they want more money – but let’s put the people first for a change.”

“The Legislature of 17 years ago was far more interested in the will of the people than the Democratic majority in charge today,” said Sen. Jeff Wilson, R-Longview. “Today’s leadership puts the desires of government first. As the result of policies enacted by the current majority, gas prices are going up, electric bills are going up, and groceries are costing more by the day. Now our friends are about to unleash higher property taxes on the populace. Where will this end?”

Said Sen. Jim McCune, R-Graham, “Property taxes in my area are high already. People are living paycheck to paycheck, and there has been no increase in salary since COVID hit. Allowing massive increases in property taxes without voter approval would do great damage to property owners in my district, to renters who would pay higher rent – to everyone.”

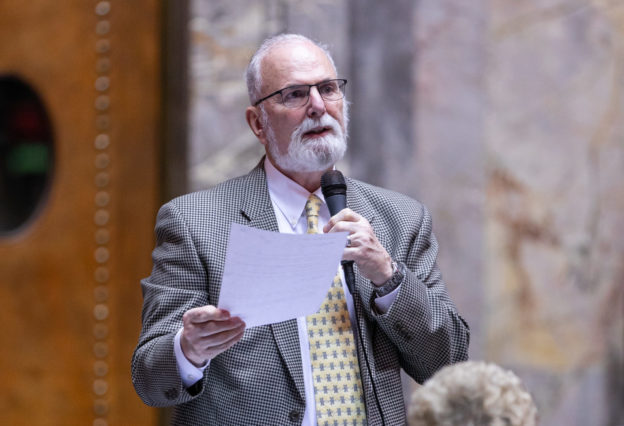

Sen. Mike Padden, R-Spokane Valley, said higher property taxes will increase the squeeze on people of moderate and fixed incomes.

“In the middle of an affordable housing crisis, and at a time when senior citizens and the disabled are worried about being taxed out of their own homes, the Senate is about to consider a bill that would allow property taxes to skyrocket,” he said. “It is the height of irresponsibility for the Legislature to be considering a bill like this one – the wrong bill at the wrong time.”

Stark contrasts revealed in approach to state’s transportation needs

Stark contrasts revealed in approach to state’s transportation needs  Announcing the formation of the ‘Freedom Caucus’

Announcing the formation of the ‘Freedom Caucus’ Continuing tax-relief efforts for seniors

Continuing tax-relief efforts for seniors