Greetings from Olympia,

Late last week, the state’s revenue forecast came out, and again tax collections are up, way up. The state is projected to take in almost $1 billion a year more than expected. The Senate Republican lead on the budget has noted that this is the “best budget situation of the 21st century.” Even before the 2019 legislative session began, I’ve been saying that our state’s economy is booming because of the federal tax cuts and deregulation. The state’s chief economist said the same thing. We can expect an additional $4.5 billion in tax collections without raising taxes.

When $50 Billion isn’t enough

So what are our friends in the majority planning on doing with all that extra money you sent to Olympia? Raise taxes, of course. Last Monday, the House Democrats unveiled their budget proposal for the state’s two-year operating budget, which relies on over $4 billion in new taxes, including an unconstitutional income tax.

The Senate majority released their proposed budget this past Friday. While the spending levels are a bit lower, and the budget doesn’t rely on new taxes, they still are considering implementing them anyway. Of particular concern is the push for an unconstitutional income tax. The proposal would increase state spending by over 16 percent. It’s a better position than what the House majority has put forward, but I’m still skeptical about the overall increases. We need to invest in mental health, we need to make sure special education is adequately funded, but I remain concerned about the ever-increasing growth in our state’s budget.

Click here to get more detailed information on both proposals.

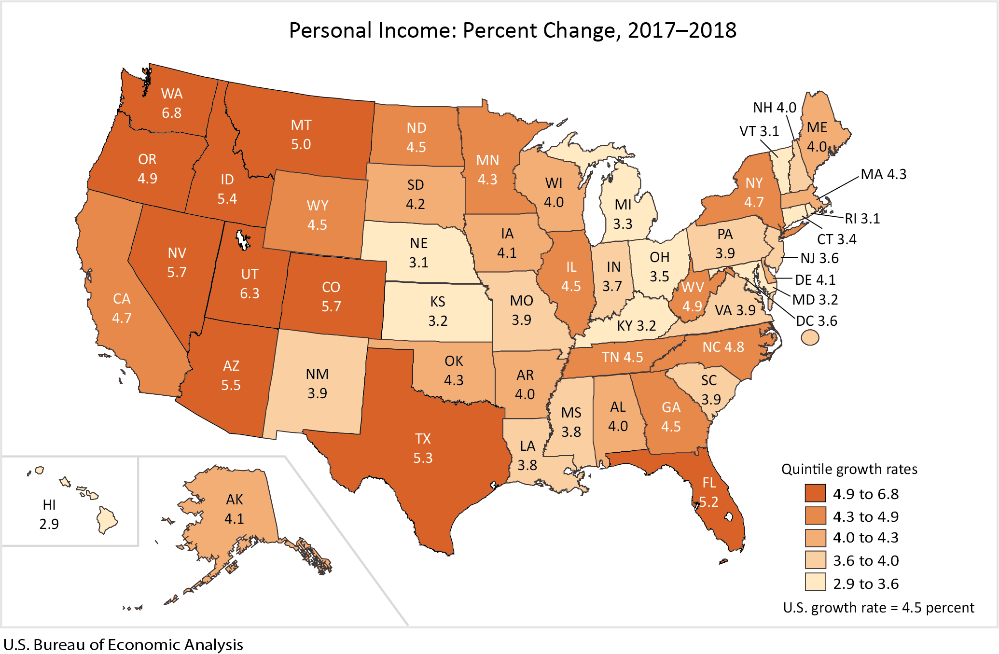

My worry is that while the tax cuts and deregulation are putting more money in people’s pockets as evidenced by the record revenue to the state, the majority is working overtime to implement new taxes and regulations that will undo all that positive momentum. Consider that the Bureau of Economic Analysis just published a report saying Washington leads the nation in personal income growth at almost 7 percent, compared to the national average of just 4.5 percent. The majority wants a 19-percent increase in state spending paid for with your money.

Social Engineering 101

I haven’t talked much about other issues going on in Olympia. I’ve been primarily concerned with fighting efforts by the Legislature to make your life harder and more expensive, but I have to say something, now. While we have real problems like addressing homelessness and mental health, the majority party has spent a considerable amount of time pushing extreme social agendas.

You’ve likely heard about efforts to implement mandatory and “comprehensive” sex education at all grade levels. We have a growing achievement and opportunity gap, and some in Olympia think we should be taking valuable classroom time away to teach kindergartners about transgender sex. Sure, parents can “opt out,” but that won’t do much good if you don’t know when schools will be indoctrinating your kids, or because it’s woven into all subjects as part of the “comprehensive” approach. This is about parents’ rights and preventing the state from sexualizing children.

Another example of this push for social engineering is the obsession with some about race and “social justice.” Using what I call “advocacy” research, people are pushing all kinds of fringe theories about race being the cause of this or the cause of that. I was in the energy-related committee the other day and one of the presenters said that studies show climate change impacts “people of color” first. I don’t necessarily think that the changing climate discriminates based on race and, of course, when I pushed back they had no real answers.

There are things we can and should be doing to ensure that people of all races and incomes are benefiting from the work we do in the Legislature, but I don’t’ think that should be determined solely by someone’s race. The unfortunate thing is that all these regressive taxes and regulations will hurt everyone in our state, including and primarily lower income people who may be “people of color,” but they don’t want to talk about that.

Watch

Click on the links below to watch short videos on policies that I’m working on regarding affordable housing and education funding.

Affordable warehousing

As people struggle to find affordable housing, the Legislature isn’t doing much to help. In fact, while I’ve promoted efforts to make building single-family homes more affordable, the majority thinks we solve our housing crisis by taxing housing MORE!

Part of the proposed House budget includes a specific increase in the real estate excise tax. So they want to take the equity in your home and use it for their efforts to provide affordable housing (apartments), without providing home-ownership opportunities to get people out of poverty. This housing affordability crisis is a self-imposed problem, and government-imposed fees and regulations are making the problem worse. If you’re a renter, I want you to be able to afford a home of your own. Home-ownership is touted by experts as one of the greatest wealth generators for low- and middle-income families. But the Legislature chooses to invest in more expensive government rental units, with no path out of poverty. If we aren’t investing and building a system that promotes affordable home-ownership, we are just warehousing low-income people and the problem will never be solved.

It is an honor serving as your state senator.

Please don’t hesitate to reach out to me with any concerns you have about your state government.

Sincerely,

Phil Fortunato,

Your 31st District State Senator