STAY CONNECTED!

Due to election year restrictions, I will be limited in how I can communicate with you about what is going on in Olympia. Please be sure to subscribe to my newsletter if you already haven’t. You can also unsubscribe at anytime by clicking here. Feel free to share this with others that live in our district.

Friends,

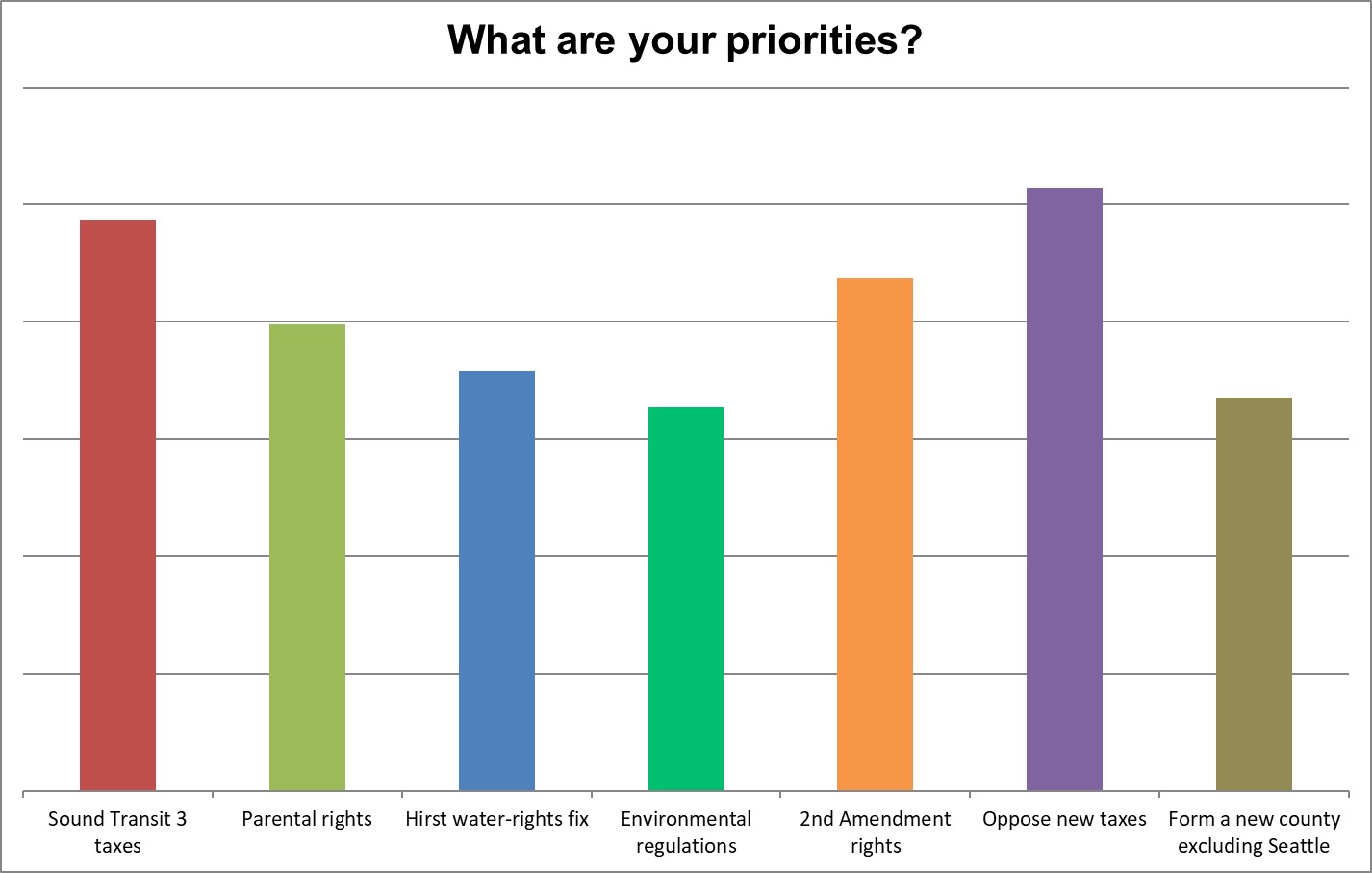

What do you think will happen in 2018? I don’t have a crystal ball, but if previous legislative sessions are any indication, Washington taxpayers should be on alert. I tried this year to amend our state’s Constitution to explicitly prohibit an income tax, the kind of money-grab Seattle is fighting for in the courts. While it did receive bipartisan support, it didn’t receive the required two-thirds approval to move on in the legislative process. Without a check on power like we’ve had with our bipartisan Majority Coalition controlling the Senate, liberal Democrats will have free reign to implement their agenda of growing state government. This coming legislative session more than ever, I am committed to protecting your wallets and defending our Second Amendment rights.

How Much is Enough?

The Senate-led effort to reform our state’s education system resulted in the biggest investment in public education in our state’s history. The budget we approved in June increased state spending on schools by nearly $4 billion this budget cycle alone. Now, half of the entire state budget is spent on education. I was hopeful that would satisfy our obligation to amply fund schools.

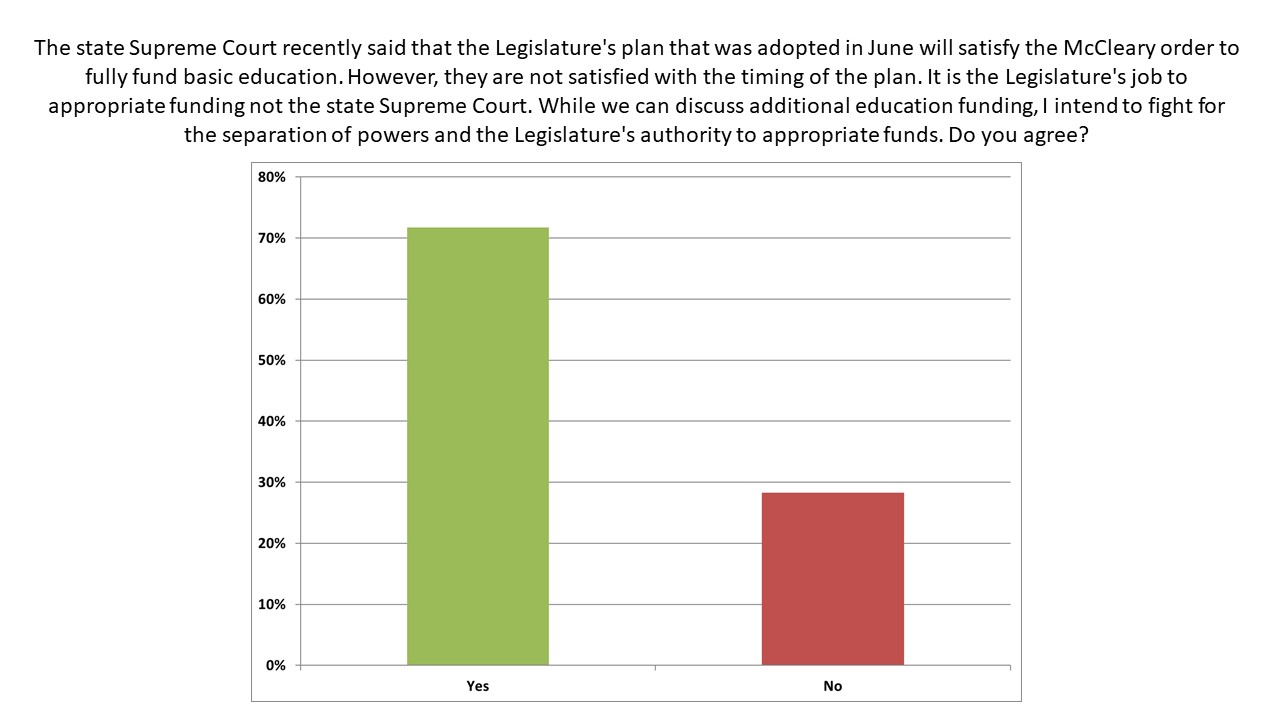

The state Supreme Court issued its ruling on the final stage of the McCleary case finding that we have fully funded basic education, but they aren’t happy with the timeline. It appears they want to add an additional $1 billion dollars earlier.

The Court has ordered the Legislature to report on how we are complying with their decision by April 2018. This could be a significant issue in the upcoming legislative session and another excuse for some progressives to sound the alarm on new taxes.

In my opinion, the Court is overstepping their authority. They are usurping legislative powers to appropriate state resources and legislating from the bench in an effort to reach into your wallets. That is not their job. You elect me and other legislators to make those spending decisions. This is a thinly veiled attempt to find another way to implement an income tax, or as it is known in Olympia, an excise tax on your income.

Concealed No More

I am keeping a close eye on the privacy of concealed carriers in our state. The Department of Licensing recently asked the state Attorney General, no friend of the Second Amendment, if they can disclose personal information of concealed carry license holders. You can read the letter DOL sent by clicking here. If the AG is determined to release information of law abiding citizens, then I think it would be appropriate for the public to have his personal information.

In another affront to rights of gun owners, the Lt. Governor recently banned firearms, even licensed concealed carry, in the Senate Gallery. He may think he isn’t infringing on your Second Amendment rights, but restricting where you can carry accomplishes the same thing. I issued an immediate response to this decision. You can read my press release and letter by clicking here.

It’s an honor to serve as your state Senator. Please don’t hesitate to reach out to my office with any questions or concerns about your state government.

Sincerely,

Phil Fortunato,

Your 31st District State Senator

|